Fixed rates and floors

Optimal finance for lenders and borrowers

Optimal finance not widely available

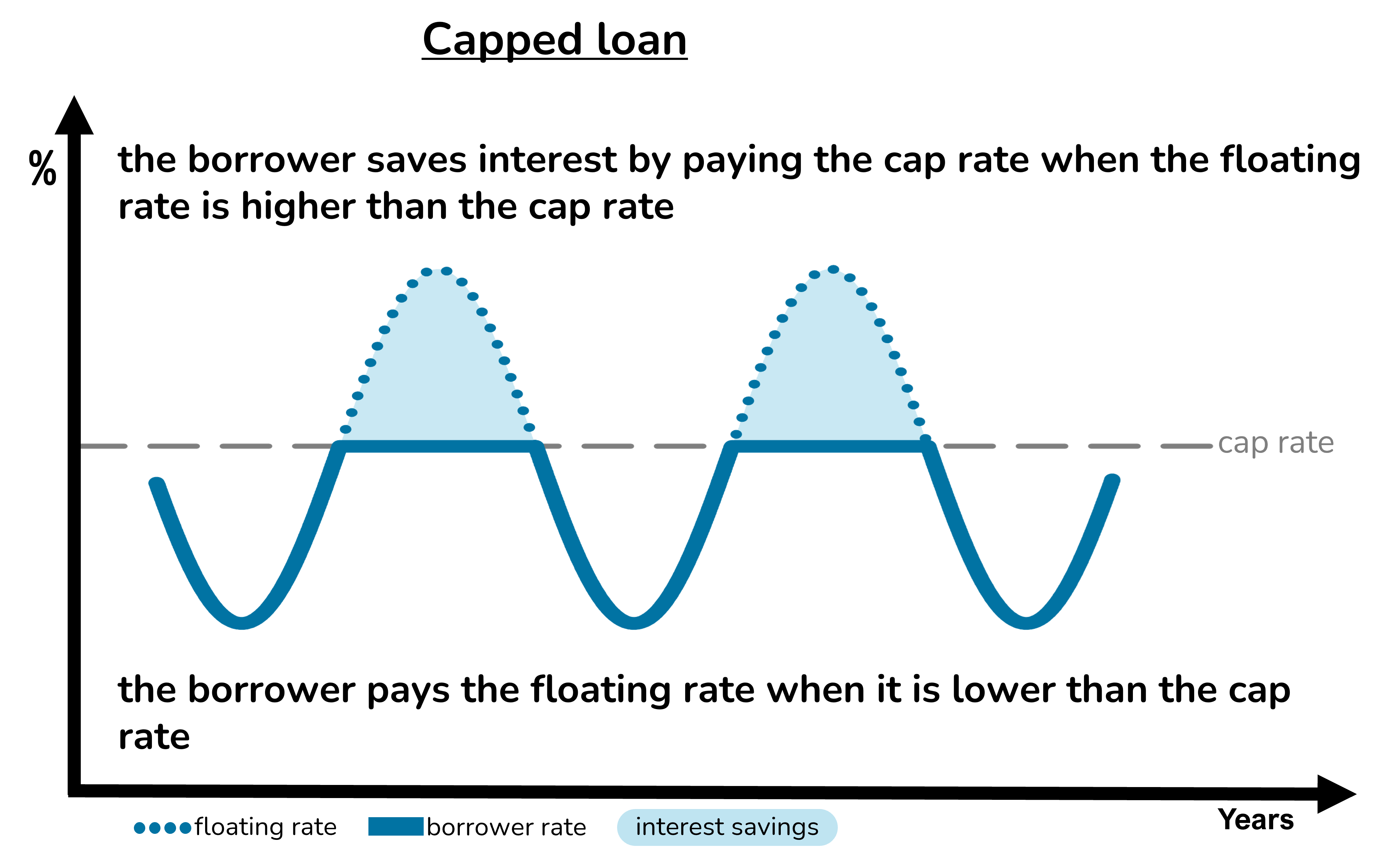

Capped floating rate loans give the borrower the least expensive rate of interest, regardless of whether rates go up or down. The borrower pays the floating rate or the cap rate, whichever is the cheaper on each applicable interest payment date:

- When the floating rate is lower than the cap rate, the borrower pays the floating rate.

- When the cap rate is lower than the floating rate, the borrower pays the cap rate.

Capped loans provide optimal financing for the borrower yet are not widely available in the UK market.

This article outlines how existing fixed rate loans can be transformed into capped floating rate loans.

Fixed rate loans in good supply

In the UK, structural and regulatory factors tend to promote fixed rate lending. Fixed rate loans are widely available and often at relatively competitive prices.

The solution for borrowers and lenders wishing to create a capped loan is to combine a fixed rate loan with a floor.

The combination transforms a normal fixed rate loan into a capped loan.

Benefits for lenders and borrowers

The transformation of a fixed rate loan into a capped loan can yield significant advantages to both borrowers and lenders:

- Borrowers can get improved access to suitable finance: cheaper loans, in larger amounts and with optimal loan interest.

- Lenders can expand loan distribution, enhance market profile, improve credit quality and boost fee income.

The transformation is particularly beneficial for lenders currently offering fixed rate loans. Fixed rate loans are not always easy to distribute. Some borrowers may be reluctant to lock into long-term fixed rates because they anticipate that rates may fall in the future. Those borrowers may prefer a loan structure that reduces their interest payments when interest rates fall.

The lender can provide the desired loan structure using their current fixed rate loan offering simply by adding a floor in the borrower’s favour. The combination creates a capped loan. The capped loan is likely to be more appealing to borrowers anticipating future rate reductions.

The strategy effectively allows the lender to distribute the same underlying fixed rate loan to an additional category of borrower.

Fixed rate loans

Embedded cap with adverse floor

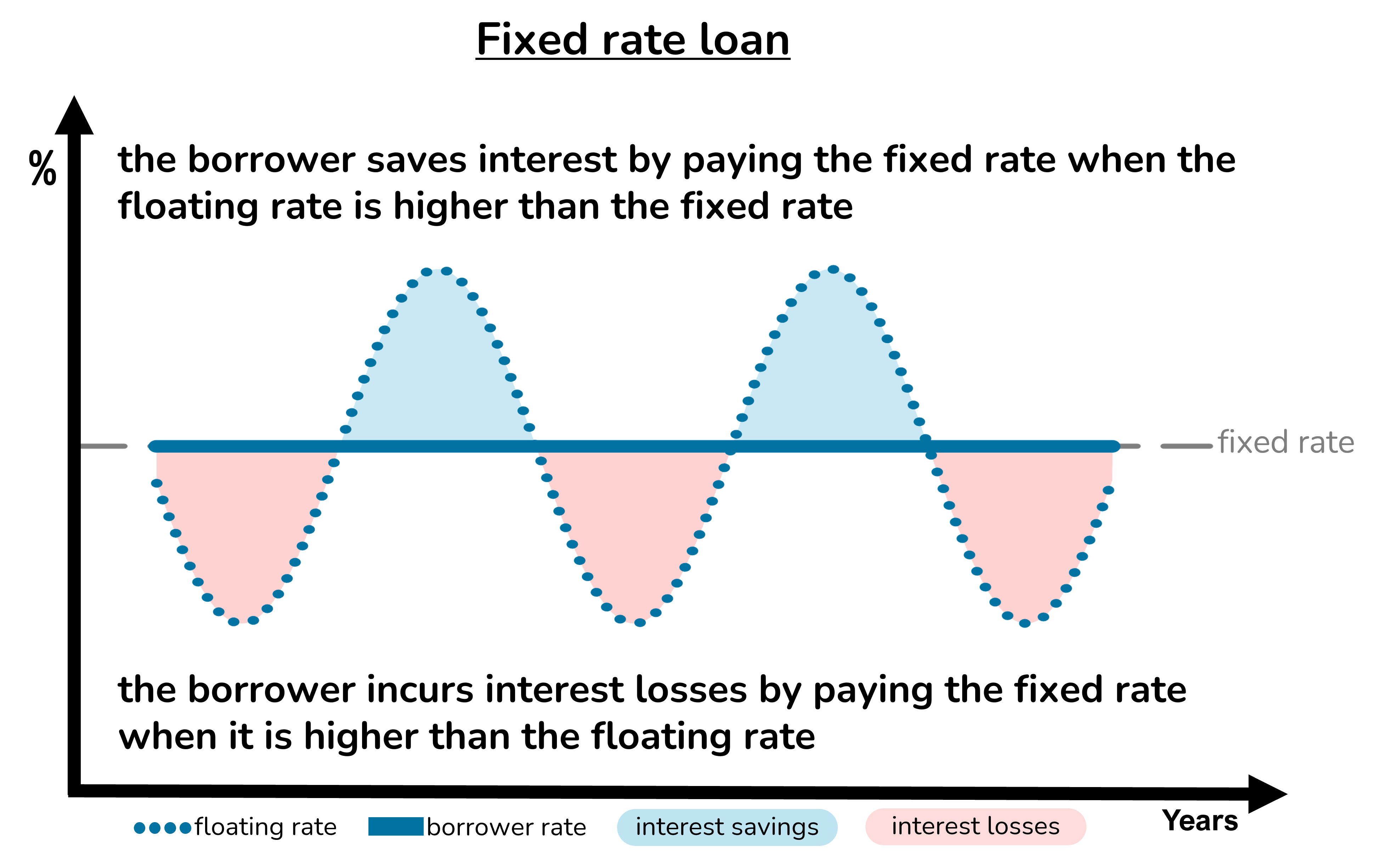

With a fixed rate loan, the borrower’s interest payments remain constant during the life of the loan regardless of the prevailing floating rate.

A fixed rate loan is equivalent to a floating rate loan with an embedded cap in favour of the borrower and an embedded floor in favour of the lender.

When the floating rate is higher than the fixed rate, the borrower pays less than the floating rate, effectively making an interest gain due to the embedded cap element. The further the floating rate exceeds the fixed rate, the greater the interest gain made by the borrower.

When the floating rate is lower than the fixed rate, the borrower pays more than the floating rate, effectively incurring an interest loss due to the embedded adverse floor element. The further the floating rate falls below the fixed rate, the greater the interest loss incurred by the borrower.

The borrower effectively pays for the interest rate cap element of the loan by simultaneously selling the interest rate floor element. The cap element protects the borrower if interest rates rise. But the adverse floor element exposes the borrower to risks if interest rates fall.

The adverse floor element may be offset by a floor in the borrower’s favour, transforming the fixed rate loan into a capped loan.

Borrower floors

Offset adverse floors

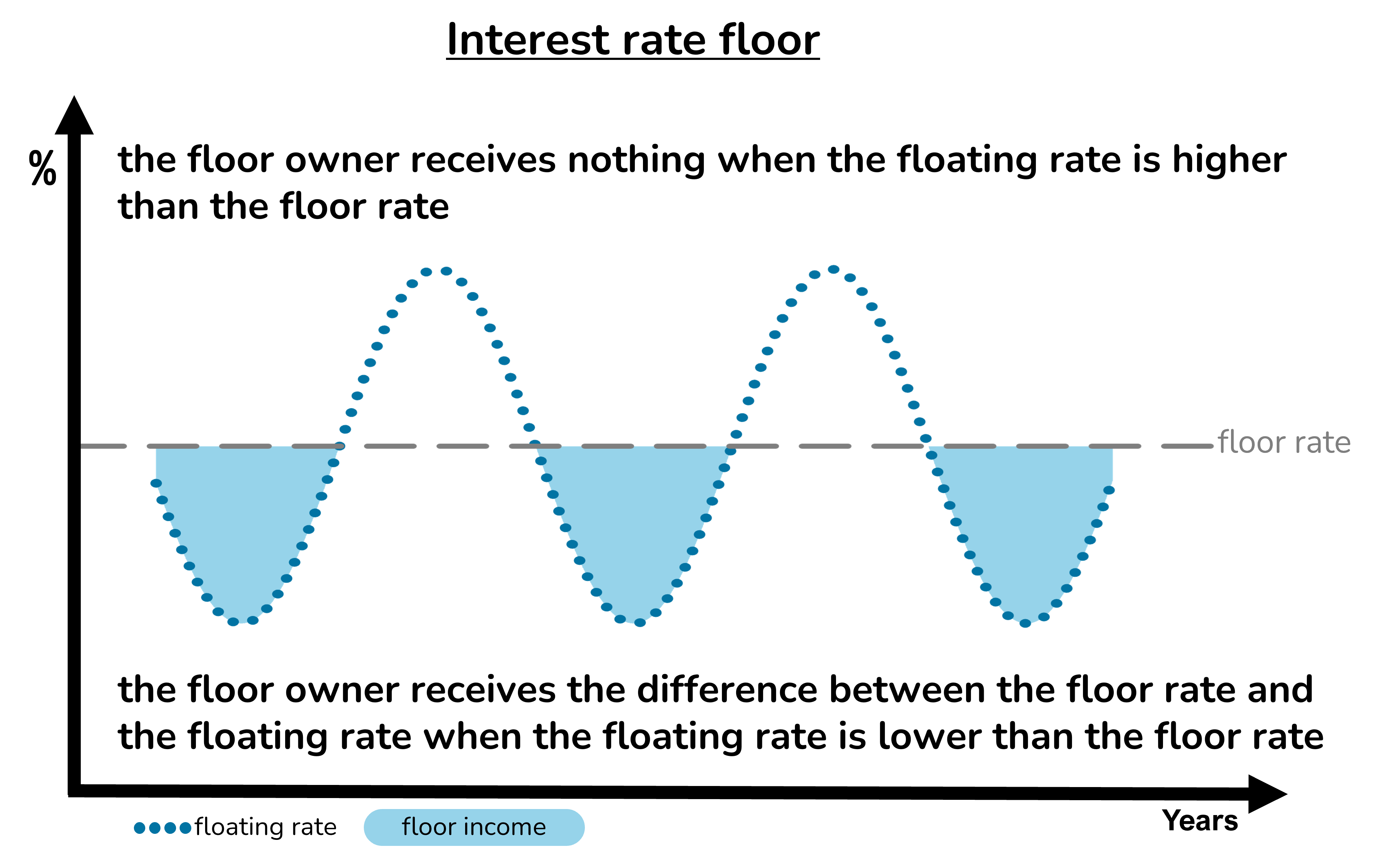

An interest rate floor acts like insurance against low interest rates.

The floor buyer pays a premium for the floor in exchange for extra income when the reference interest rate falls below a chosen minimum, the floor rate. The further the rate falls below the floor rate, the greater the income from the floor. When the rate is at or above the floor rate, the floor owner receives no income from the floor.

A floor in favour of the borrower offsets the adverse floor embedded in a fixed rate loan.

Floors are premium products. The premium may be paid upfront or in instalments.

Floating rate benchmarks

Base Rate or SONIA

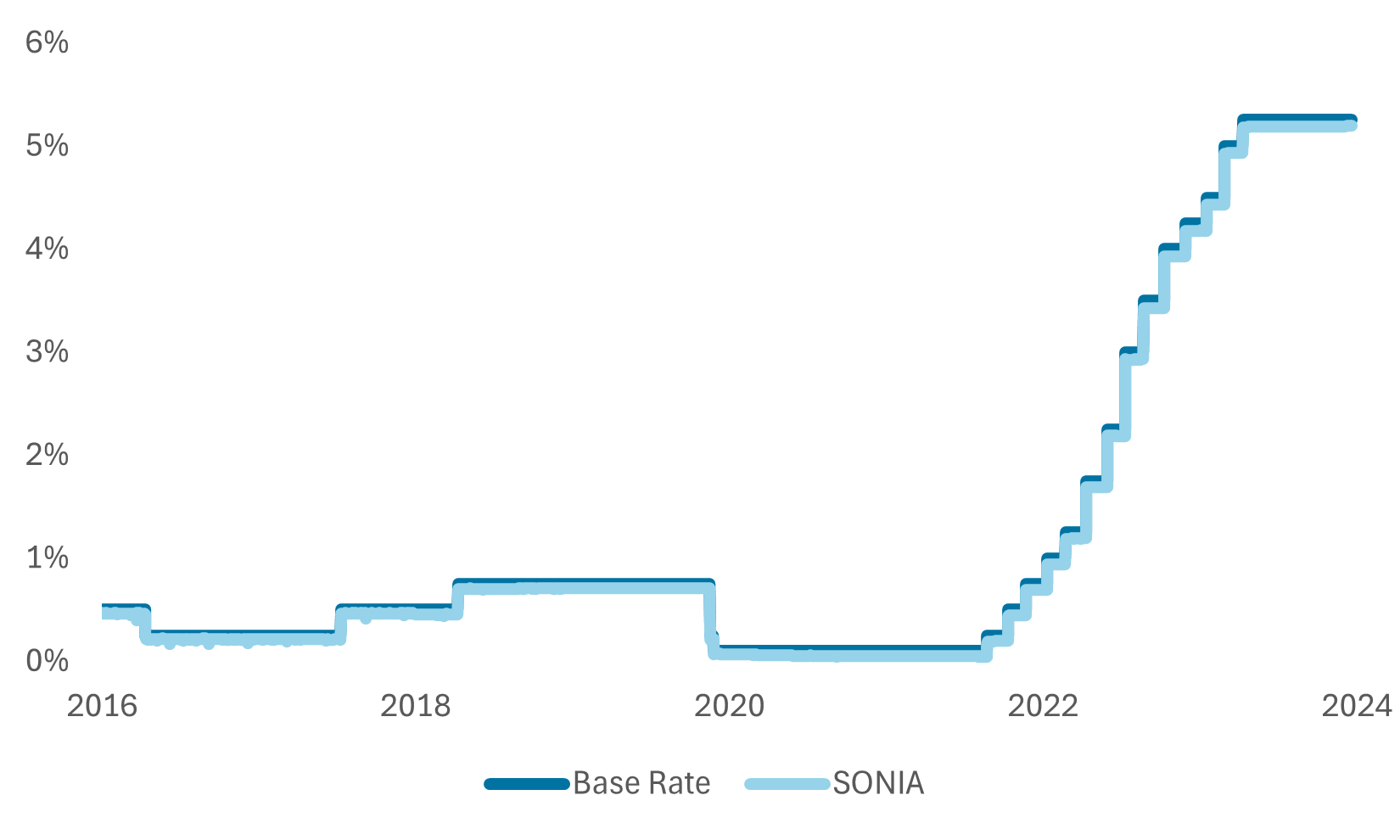

The reference interest rate for caps, floors and capped loans is normally Base Rate or SONIA,

Base Rate is the Bank of England Official Bank Rate as published by the Bank of England. Base Rate determines the interest rate paid to commercial banks that hold money with the Bank of England.

SONIA (Sterling Overnight Index Average) is a benchmark interest rate administered by the Bank of England. SONIA is based on actual transactions and reflects the average of the interest rates that banks pay to borrow sterling overnight from other financial institutions.

Historically, Base Rate and SONIA have moved closely in line with one another, although there is no guarantee that the two rates may not de-couple in the future.

Caps and floors referenced to SONIA tend to be traded more competitively than their Base Rate alternatives. As a result, capped loans referenced to SONIA tend to be cheaper than those referenced to Base Rate.

How is the premium paid?

Upfront or in instalments

The premium for a borrower floor is normally paid upfront by the borrower. This is generally the case when the floor is purchased independently of the loan or loans it is hedging.

Some lenders offer deferred premium floors, where the premium is payable in instalments over the life of the floor regardless of what happens to interest rates. By deferring the premium payable, the lender is effectively lending the floor buyer the money to pay the floor premium so will apply a funding charge and may require additional security.

Borrowers may create their own ‘do-it-yourself’ deferred premium payments by borrowing extra to pay the upfront floor premium cost and then repaying the extra amount borrowed in instalments over the life of the floor.

The capped rate loan or capped rate mortgage will have a higher effective interest rate if the floor premium is paid in instalments, because the loan interest includes the instalment payments.

The instalments calculator shows how an upfront premium can be paid in instalments.

Examples

Capped loans created by fixed rates with floors

The examples below demonstrate two capped loans created by combining a specified underlying fixed rate loan with an interest rate floor.

Underlying fixed rate loan

| Loan amount | £500,000 |

| Duration | 5 years |

| Fixed rate | 4% |

| Interest payments | Monthly |

Interest rate floor

| Amount protected | £500,000 |

| Duration | 5 years |

| Floor rate | 5% |

| Floating reference rate | SONIA |

| Floor payments | Monthly |

In the first example, the floor premium is paid upfront. In the second example, the floor premium is paid in instalments over the life of the loan.

Example 1 – Premium paid upfront

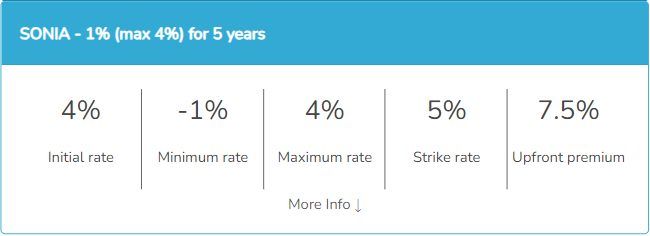

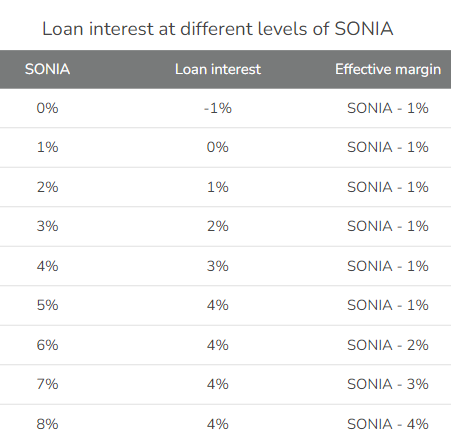

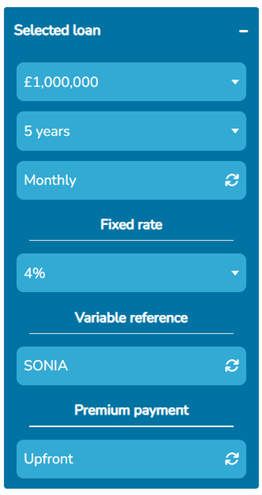

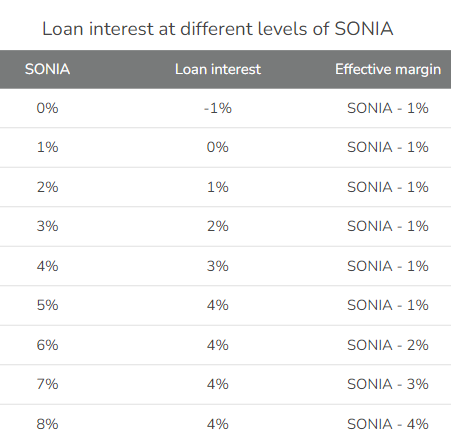

The capped loan has a floating interest rate of 1% below SONIA, with a maximum all-in rate of 4%. The minimum all-in interest rate is minus 1%. The initial rate is 4%, equivalent to current SONIA minus 1.2%. The upfront premium for the floor is 7.5%.

When SONIA is below 5%, the loan interest rate tracks SONIA downwards as shown in the table below.

Example 2 – Premium paid in instalments

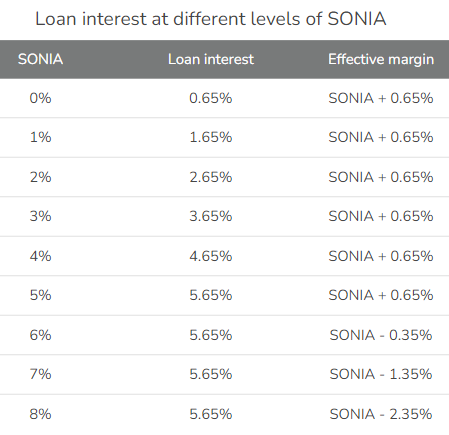

Some borrowers may prefer to pay the floor premium in instalments rather than upfront. In the current example, the 7.5% upfront premium is replaced by 1.65% instalments added to the loan interest rate.

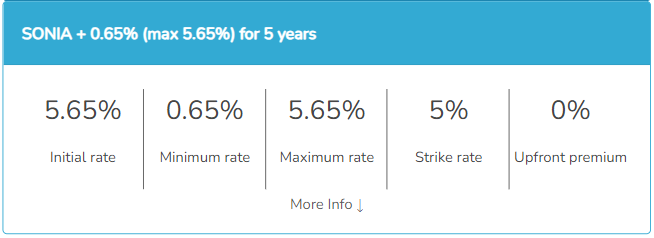

The capped loan has a floating interest rate of SONIA + 0.65%, with a maximum all-in rate of 5.65%. The minimum all-in interest rate is 0.65%. The initial rate is 5.65%, equivalent to current SONIA plus 0.45%. There is no upfront premium for the floor. The instalment payments for the floor have been included in the loan interest rate

When SONIA is below 5%, the loan interest rate tracks SONIA downwards as shown in the table below.

Analysis

Benefits for the borrower and the lender

Borrower perspective

The strategy gives borrowers a greater choice of financing options, improved access to finance in general and improved access to suitable finance in particular.

Suitability: The strategy achieves capped floating rate funding, which is suitable for many borrowers, including those who wish to benefit from anticipated future falls in interest rates. Capped rate loans and capped rate mortgages allow borrowers to benefit from falls in interest rates, while protecting them in case rates should rise.

Availability: Capped loans are not always widely available in the UK market. The strategy allows borrowers to obtain capped loans via fixed rate loans, giving those borrowers a wider choice of potential lenders.

Pricing: The strategy tends to convert competitively priced fixed rate loans into competitively priced capped loans. This may achieve cheaper financing costs for the borrower than would otherwise be available.

Loan amount: The borrower may have access to a larger loan amount than would be available on a normal floating rate basis. This is because the underlying loan is a fixed rate loan. The rules governing UK lenders tend to allow a larger loan amount to a fixed rate borrower than would be available to the same borrower on a floating rate basis.

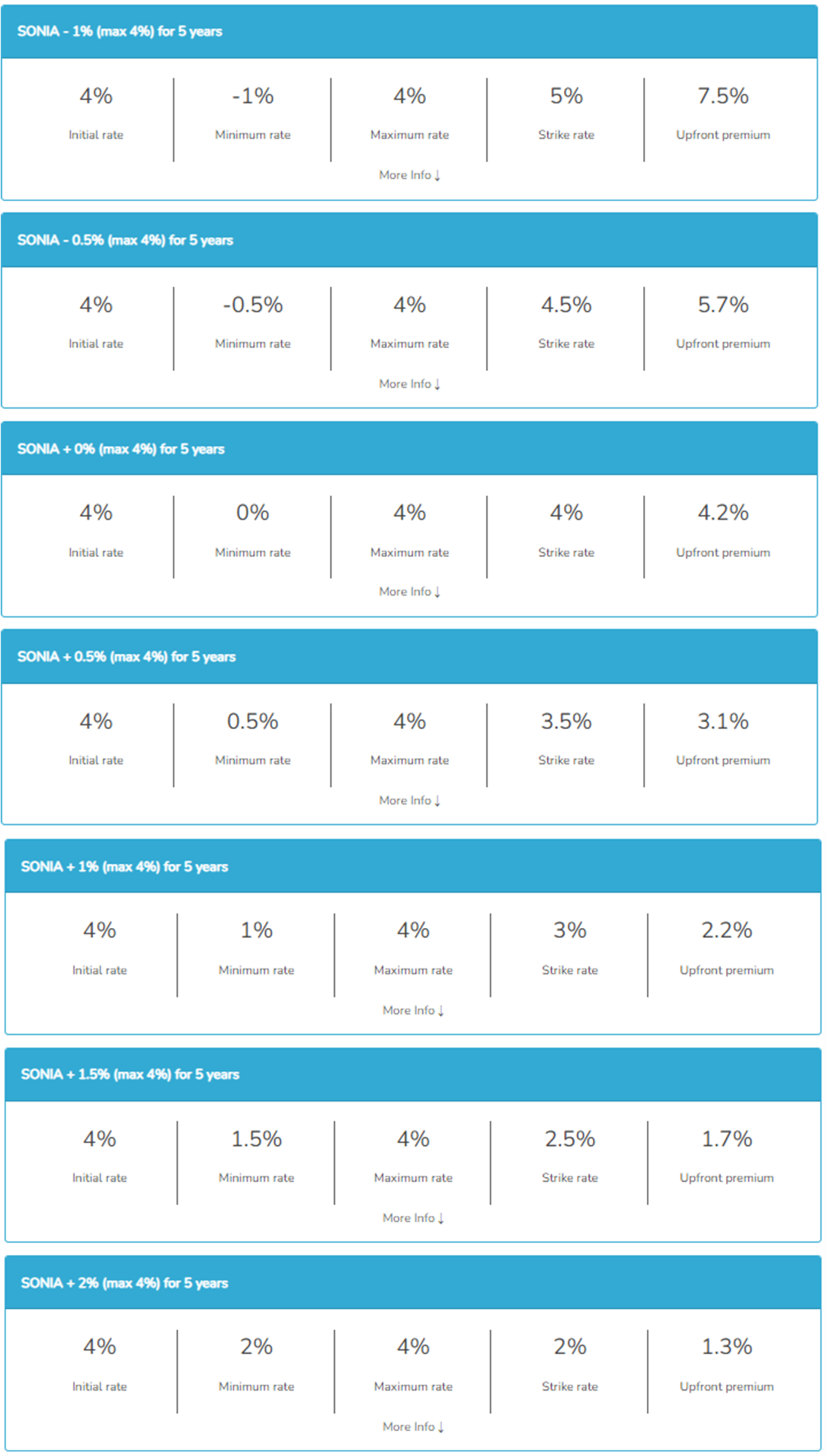

Flexibility: The floor premium can be paid upfront, in instalments, or a blend of the two. The amount of premium can be adjusted upwards or downwards by selecting a higher or lower strike rate, as can be viewed on the capped loan table.

Lender perspective

The strategy gives the lender the opportunity to benefit from broader distribution of its product, enhanced market profile, improved credit quality and increased fee income.

Distribution: The strategy allows a lender offering fixed rate loans to attract a wider range of possible borrowers to its underlying product. The addition of the floor converts the underlying fixed rate loan into a capped loan. The lender can offer the same underlying fixed rate loan to two distinct categories of borrower:

- Borrowers wanting fixed rate financing may take the underlying fixed rate loan on the normal basis.

- Borrowers not wanting fixed rate financing may take the same underlying fixed rate loan transformed into a capped loan via the simple addition of the floor.

Whichever category of borrower takes the loan, the lender’s net cash flows remain unchanged, as illustrated in Appendix II below. The addition of the second borrower category simply increases the lender’s potential to distribute the same underlying fixed rate loan.

Market profile: Capped loans are not always widely available in the current market. A lender adding capped loans to its product options may enhance its market profile in the eyes of borrowers and intermediaries.

Credit quality: The capped loan created by the strategy has superior credit characteristics compared to the underlying fixed rate loan without the floor:

- Loan to value: the lender’s ownership of the floor increases the value of its security and so improves loan to value ratio.

- Interest coverage: the potentially lower interest payments under the capped loan make the borrower better placed to meet interest obligations.

Fee income: The lender may potentially earn more fee income via the capped rate loan or capped rate mortgage than it would otherwise earn via the underlying fixed rate loan. The additional fee income could be in the form of a percentage of the floor premium, potential extra spread income via the floor, or both.

Flexibility: The floor premium can be paid upfront, in instalments, or a blend of the two. The amount of premium can be adjusted upwards or downwards by selecting a higher or lower strike rate, as can be viewed on the capped loan table.

Summary

Benefits for all

The combination of fixed rate loans with interest rate floors generates benefits for both borrowers and lenders.

Borrowers may use the strategy to obtain a greater choice of financing options, improved access to finance in general and improved access to suitable finance in particular. Other potential benefits include larger loan amounts and cheaper loan pricing.

Potential benefits to lenders include broader distribution of their loans, enhanced market profile, improved credit quality and increased fee income.

Please view the capped loan calculator to see how fixed rate loans may be converted into capped loans.

Appendix 1 – Capped loan table

How to use the table

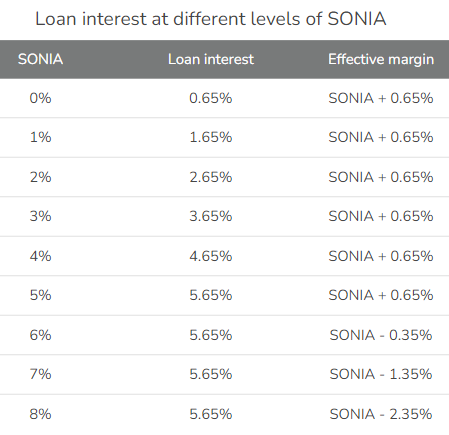

The capped loan calculator illustrates the strategy outlined in this article.

Users select the underlying fixed rate loan by specifying its amount, duration, payment dates and fixed rate; they also choose the floating reference rate (SONIA or Base rate) and whether floor premium is paid upfront or in instalments.

The table displays the capped loans created by combining the selected loan with interest rate floors at a range of strike rates; the strike rate is the level below which the loan interest tracks the floating reference rate.

The table shows the initial, maximum and minimum loan interest rates of the capped loan, as well as the strike rate of the floor and the upfront premium, if applicable.

The full cash flows of each loan can be viewed by clicking the “More info” tab.

Please click here for detailed instructions about how to use the capped loan calculator.

Appendix 2 – Lender cash flows

Identical to receipts from fixed rate loan

The lender’s net cash flows remain identical to those of the underlying fixed rate loan, regardless of the level of interest rates or whether the floor premium is paid upfront by the borrower or paid in instalments.

Example 1 – Premium paid upfront

The cash flow tables below show the borrower and lender cash flows under the capped loan.

Borrower cash flows (premium paid upfront)

The borrower pays 4% or SONIA minus 1%, whichever is the lower, as shown in the table below.

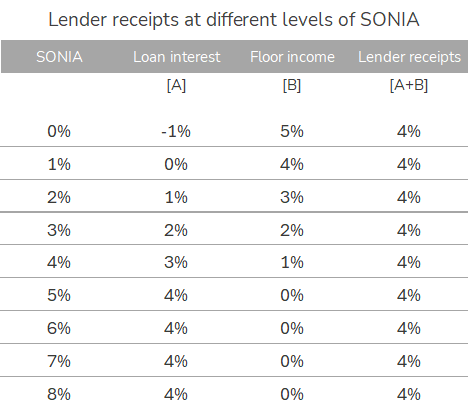

Lender cash flows (premium paid upfront)

The lender always receives a total of 4%, regardless of the level of interest rates.

Whenever the borrower’s loan interest payment is less than 4%, the lender’s net receipts are topped up to 4% by the income received by the lender from the floor, as shown in the table below.

Example 2 – Premium paid in instalments

Borrower cash flows (premium in instalments)

The borrower pays no upfront premium for the floor but pays in instalments which add 1.65% to the loan interest rate.

The borrower pays 5.65% or SONIA + 0.65%, whichever is the lower, as shown in the table below.

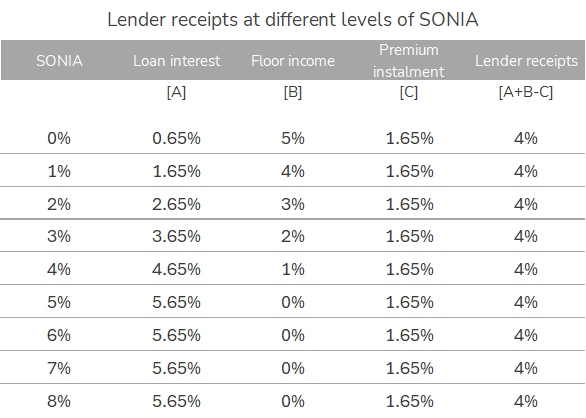

Lender cash flows (premium in instalments)

Whenever the borrower’s loan interest payment is less than 5.65%, the lender’s gross receipts are topped up to 5.65% by the income received by the lender from the floor.

After taking account of the 1.65% premium instalments, the lender always receives a net 4%, regardless of the level of interest rates, as shown in the table below.