Capped loans

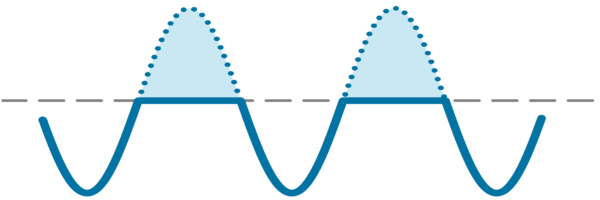

Capped rate loans are less risky than fixed or floating rate loans because they give the borrower the cheapest rate of interest, regardless of whether rates go up or down. Capped rate loans have traditionally been available only to larger borrowers. The links below explain how small and medium-sized borrowers may obtain capped rate loans.

Article describing the mechanics of capped rate loans, which are a new option for some borrowers.

The calculator shows how existing fixed or floating rate loans can be converted into capped rate loans.