Strategies for borrowers

Optimal finance

This article explains how borrowers can use a cap or a floor to get improved access to suitable finance: cheaper loans, in larger amounts, from a wider choice of lenders, at lower risk and with optimal loan interest.

The two loan types typically available to borrowers in the UK are fixed rate or floating rate loans. Neither option is optimal. Fixed rate loans expose borrowers to risks if rates fall. Floating rate loans expose borrowers to higher interest payments if rates rise.

The optimal financing solution for most borrowers is a capped floating rate loan. Capped loans give the borrower the lowest risk and the optimal interest rate.

Either loan type may be optimised using a cap or a floor; the optimisation enables the borrower to reduce risks and achieve the five objectives listed above.

The five objectives are connected to one another:

- Cheaper loans and larger loan amounts are available to borrowers having a wider choice of lenders and underlying loan type.

- A wider choice of lenders is available to borrowers with greater flexibility in terms of underlying loan type and lower risks.

- Lower risks are achieved by optimising the underlying loan.

- Optimal loan interest is achieved using a cap or a floor according to the relevant underlying loan type.

The objectives are achieved by converting normal fixed or floating rate loans into capped loans.

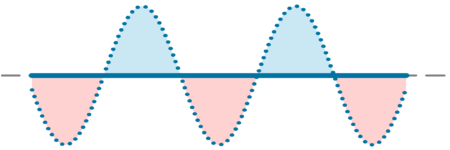

Capped loans give the borrower the lowest risk and the optimal interest rate. The borrower pays the floating rate or the cap rate, whichever is the cheaper on each applicable interest payment date:

- When the floating rate is lower than the cap rate, the borrower pays the floating rate.

- When the floating rate is higher than the cap rate, the borrower pays the cap rate.

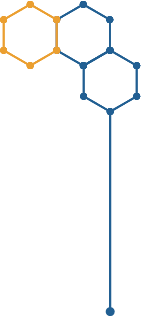

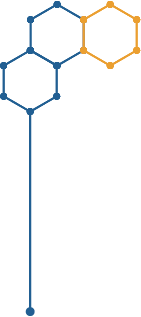

The choice of lenders is maximised because capped loans may be created from either loan type:

- Fixed rate loans can be converted into capped loans via a floor in the borrower’s favour.

- Floating rate loans can be converted into capped loans via a cap in the borrower’s favour.

The cost of either strategy is the premium payable for the cap or floor. The premium may be paid upfront or in instalments over the life of the loan.

The benefits of the strategy include reduced risks, access to a wider choice of lenders and underlying loan types and opportunities to obtain cheaper loans in larger amounts.

Examples of strategy

Adding a cap or floor to a normal loan

The objective of the strategy is to get improved access to suitable finance: cheaper loans, in larger amounts, from a wider choice of lenders, at lower risk and with optimal loan interest.

Borrowers may either combine a normal fixed rate loan with a favourable floor or else combine a normal floating rate loan with a cap.

The two alternatives each achieve optimal capped floating rate finance. Capped loans give the borrower the lowest risk and the optimal interest rate. The borrower pays the floating rate or the cap rate, whichever is the cheaper on each applicable interest payment date.

The two alternatives are outlined below.

Fixed rate loan

Fixed rate loans give the borrower known, fixed, payments for the duration of the fixed rate period. But they also expose the borrower to risks should interest rates fall. The borrower risks becoming trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. The adverse floor element of a fixed rate loan may also impact the borrower’s loan-to-value position.

The risks of a fixed rate loan can be managed with a favourable floor. A favourable floor protects its owner against falling interest rates.

The floor owner receives extra income when the floating rate is lower than the floor rate. The further the floating rate falls below the floor rate, the greater the extra income from the floor.

The favourable floor offsets the risks of a fixed rate loan by converting it into a capped loan, minimising the borrower’s risks and providing the optimal interest rate whether rates go up or down.

Floating rate loan

Floating rate loans allow the borrower to benefit from lower interest payments when the floating rate is low. But the risk to the borrower is that there is no upper limit on the interest rate they will have to pay should the floating rate rise.

The risk of a floating rate loan can be managed with an interest rate cap.

A cap acts as insurance against high floating rates.

The cap owner receives extra income when the floating rate is higher than the cap rate. The extra income offsets the higher interest costs of the floating rate loan.

The cap offsets the risks of a floating rate loan by converting it into a capped loan, minimising the borrower’s risks and providing the optimal interest rate whether rates go up or down.

Analysis

Optimal finance

Combining a fixed rate loan with a favourable floor or combining a floating rate loan with a cap creates advantages for the borrower:

- Suitability: The strategy achieves capped floating rate funding, which is suitable for many borrowers, including those who wish to benefit from anticipated future falls in interest rates. Capped loans allow borrowers to benefit from falls in interest rates, while protecting them in case rates should rise.

- Availability: Capped loans are not always widely available in the UK market. The strategy allows borrowers to obtain capped loans via fixed rate loans or floating rate loans, giving the borrower a wider choice of potential lenders.

- Pricing: The strategy tends to convert competitively priced fixed or floating rate loans into competitively priced capped loans. This may achieve cheaper financing costs for the borrower than would otherwise be available.

- Loan amount: The borrower may have access to a larger loan amount than would be available on a normal floating rate basis. This is because one of the options involves an underlying fixed rate loan. The rules governing UK lenders tend to allow a larger loan amount to a fixed rate borrower than would be available to the same borrower on a floating rate basis.

- Flexibility: The cap or floor premium can be paid upfront, in instalments, or a blend of the two. The amount of premium can be adjusted upwards or downwards by selecting a higher or lower strike rate, as can be viewed on the capped loan table.

How is the premium paid?

Upfront or in instalments

The cost of the strategy described above is the premium payable for the relevant cap or floor.

The premium for a cap or floor is normally paid upfront by the borrower. This is generally the case when the option is purchased independently of the loan or loans it is hedging.

Some lenders offer deferred premium options, where the premium is payable in instalments over the life of the cap or floor regardless of what happens to interest rates. By deferring the premium payable, the lender is effectively lending the borrower the money to pay the premium so will apply a funding charge and may require additional security.

Borrowers may create their own ‘do-it-yourself’ deferred premium payments by borrowing extra to pay the upfront premium cost and then repaying the extra amount borrowed in instalments over the life of the loan.

Deferring the premium cost avoids the need for the borrower to make an upfront payment. But the instalment payments effectively add to the interest costs of the loan.

Summary

Costs and benefits of strategy

The strategy outlined above explains how borrowers can use a cap or a floor to get improved access to suitable finance.

The cost of the strategy is the premium payable for the applicable cap or floor.

The benefits of the strategy include:

- Optimal loan interest via the conversion of normal fixed and floating rate loans into capped loans. The borrower pays the floating rate or the cap rate, whichever is the cheaper on each applicable interest payment date.

- Lower risks as the result of the optimisation of the loan interest. Borrowers with capped loans have less risk of being unable to meet interest payments and are better placed to meet lenders’ affordability assessments.

- A wider choice of lenders because of the lower risks and the borrower’s increased flexibility in terms of the type of underlying loan.

- The opportunity to obtain cheaper loans with larger loan amounts by being able to access a wider choice of lenders and underlying loan type.