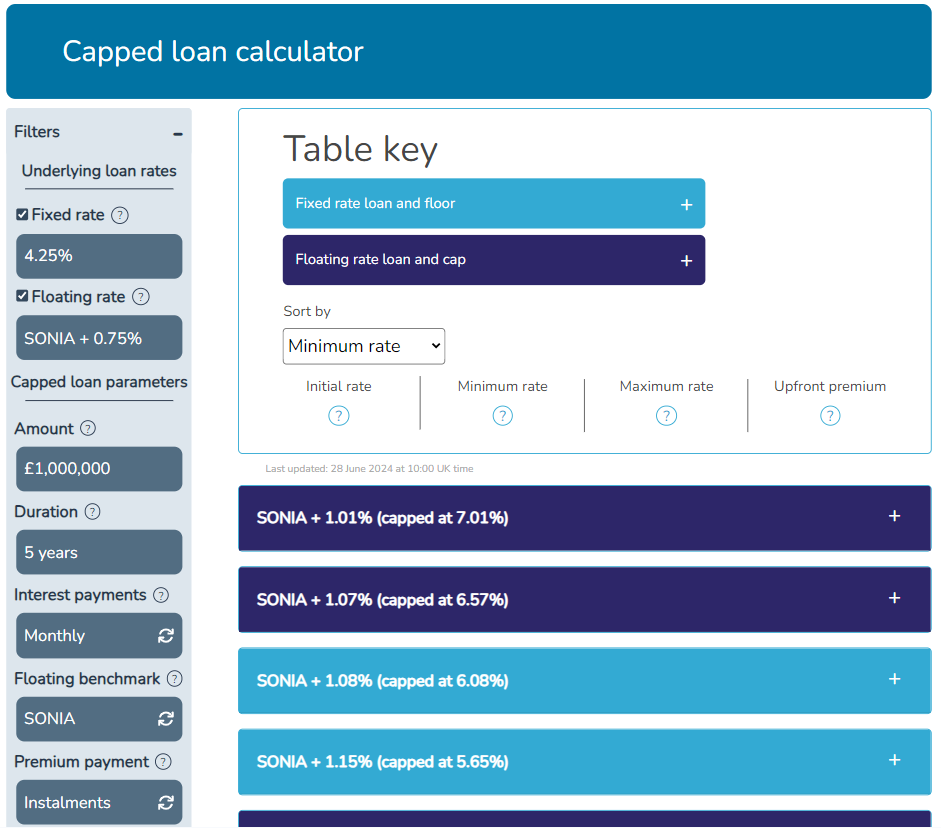

Capped loan calculator

How to use the calculator

The calculator shows the capped loans that can be created from an existing fixed and/or floating rate loan.

How to use the calculator:

- Enter the interest rate of the underlying fixed or floating rate loans.

- Select parameters (amount, duration etc.) for the capped loan.

- Sort the table of alternative capped loans as required (e.g. by minimum or maximum rate).

- Click on “More info” for fuller details of each alternative.

Underlying loan rates

Fixed and/or floating rate

Enter the interest rates of the underlying fixed and floating rate loans from which the capped loans can be created.

If either the fixed rate or the floating rate underlying loan is not available, uncheck that option.

Tip: The floating benchmark can be edited directly via the “Floating rate” filter. “B+1” will be interpreted as Base Rate + 1%, “S+.5” as SONIA + 0.5% and so on. Alternatively, the floating benchmark can be set using the “Floating benchmark” toggle button.

Capped loan parameters

Details of the required capped loan

Select the parameters of the required capped loan using the filters.

The amount, duration and interest payment dates should match those of the underlying fixed or floating loan.

Tip: The amount filter accepts “500K” for £500,000, “1.2M” for £1,200,000, “5m” for £5,000,000 and so on. The minimum amount of the capped loan is £100K.

Tip: The duration filter accepts “1.5Y” or “1.5” for 18 months. “5y” or “5” for 5 years and so on. The duration should be between 1 year and 10 years.

Select the interest payment dates of the capped loan using the toggle button, i.e. monthly or quarterly to match the interest payment dates of the underlying loan.

Select the floating rate benchmark of the required capped loan using the toggle button, i.e. SONIA or Base Rate.

(If the underlying loan is floating rate, the capped loan will have the same floating benchmark as the underlying loan.)

Tip: Caps and floors referenced to Base Rate are less actively traded so tend to be more expensive than their SONIA equivalents. Accordingly, capped loans referenced to SONIA tend to be more competitively priced than those referenced to Base Rate.

Use the toggle button to select whether the premium for the relevant cap or floor is paid upfront or in instalments over the life of the loan.

- If the premium is paid upfront, the capped loan will have a lower interest rate.

- If the premium is paid in instalments, there will be no upfront premium but the capped loan will have a higher interest rate (because the instalment payments are included in the interest rate).

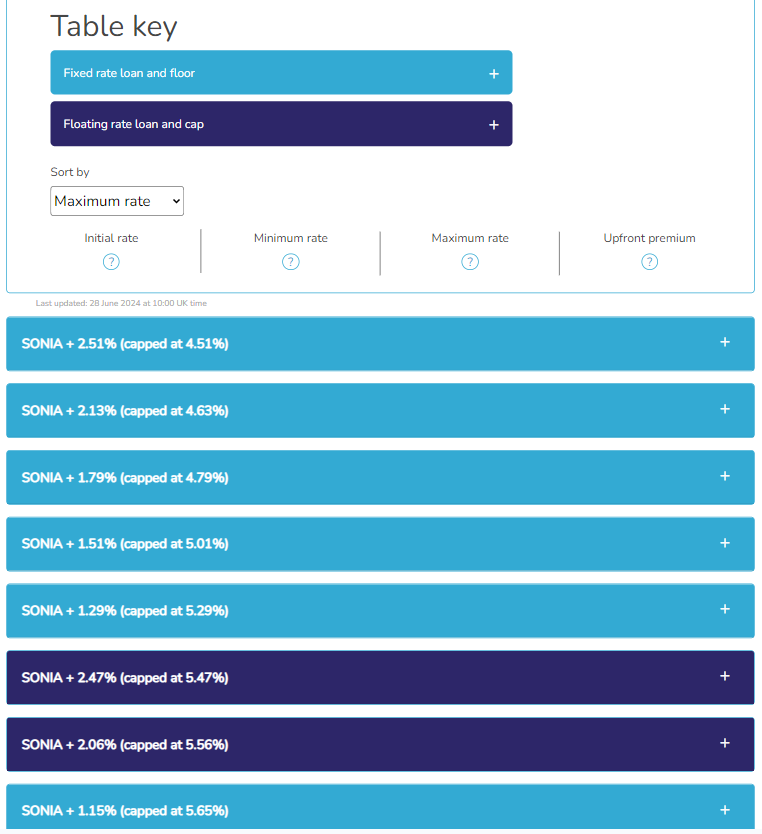

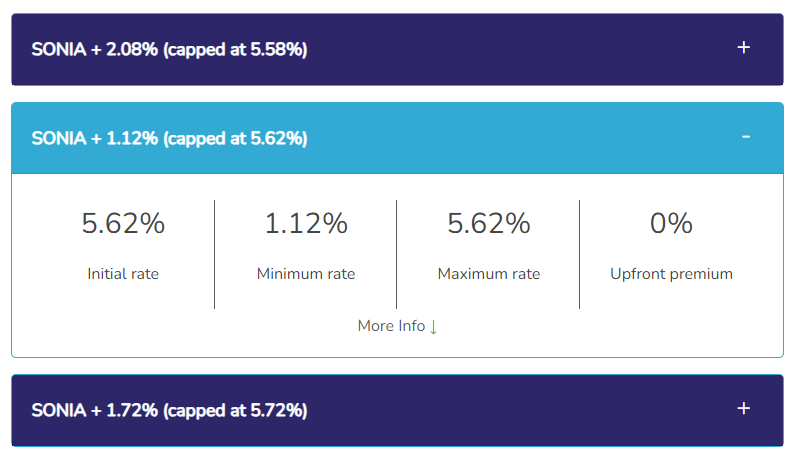

Sorting the table

E.g. by maximum rate

Use the “Sort by” dropdown to sort the table according to different characteristics:

- Initial rate – the interest rate of the capped loan at the current level of the floating benchmark.

- Minimum rate – the interest rate of the capped loan when the floating benchmark is 0%

- Maximum rate – the maximum interest rate of the capped loan (likely to be a factor when assessing affordability).

- Upfront premium – the upfront premium expressed as a percentage of the loan amount. (If the premium is paid in instalments, the upfront premium is 0%.)

Expanded view

Key features of each capped loan

More info

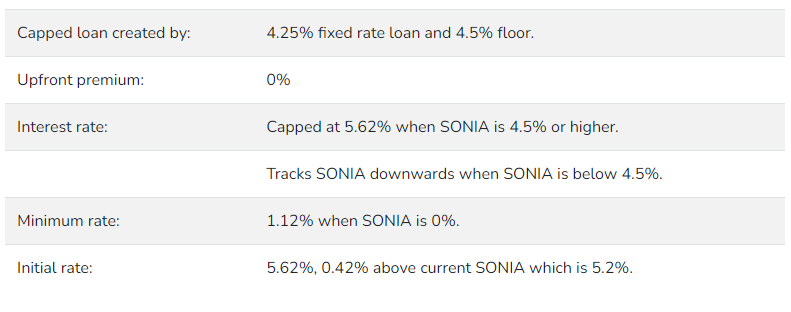

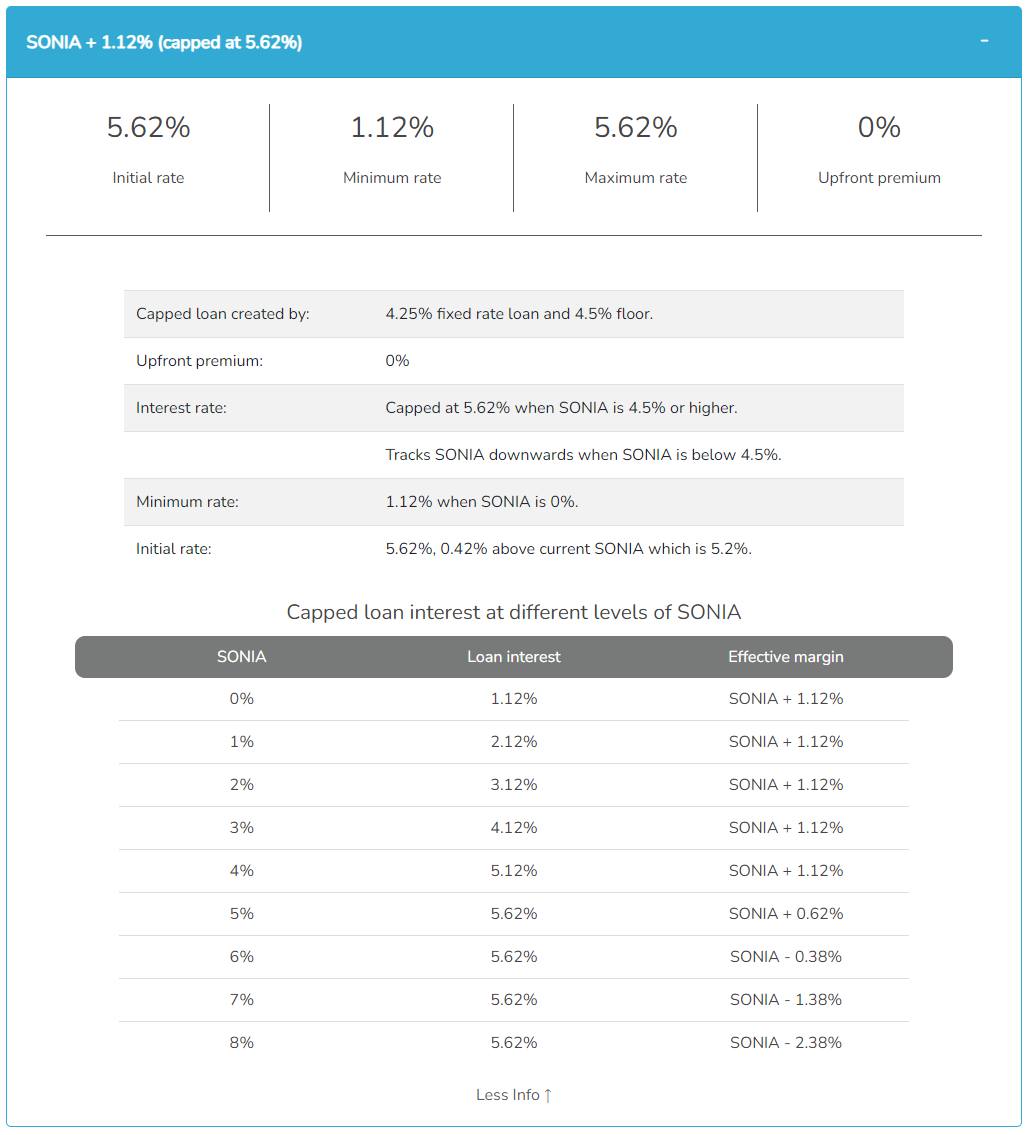

Fuller details of capped loan

Click “More info” to show fuller details of a particular capped loan (and click “Less info” to hide the details).

This particular capped loan is created by combining the underlying 4.25% fixed rate loan with a 4.5% floor.

There is no upfront premium for the loan (because the premium is paid in instalments which are included in the loan interest).

The loan interest is capped at 5.62% when the floating benchmark (SONIA) is 4.5% or higher, and tracks SONIA downwards when SONIA is below 4.5%. The minimum loan interest is 1.12% (when SONIA is 0%).

The initial interest rate of the capped loan is 5.62%, equivalent to 0.42% above current SONIA (5.2%).

(The table shows the interest rate of the capped loan at different levels of SONIA.)