What is a capped loan?

Optimal financing

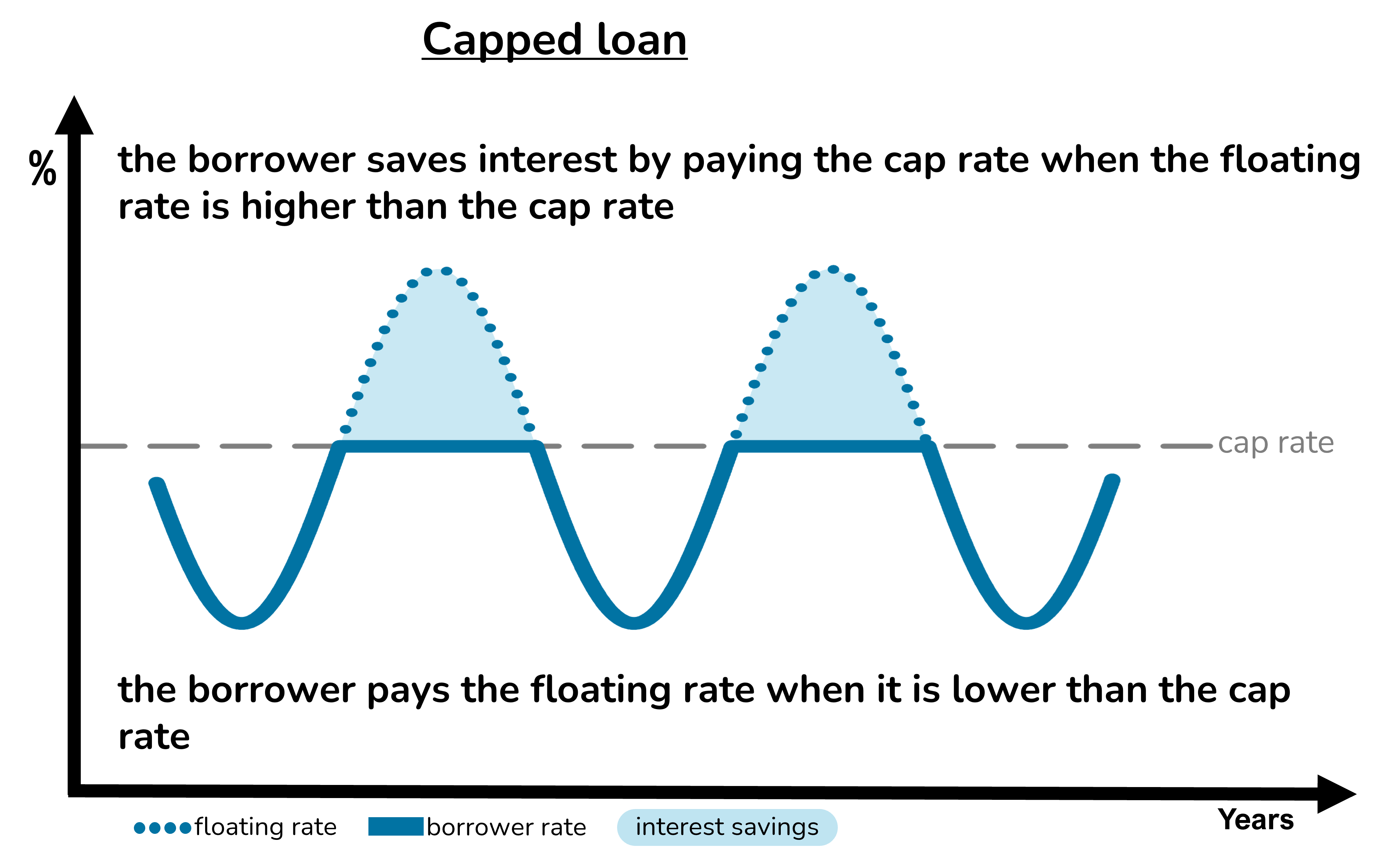

With a capped rate loan or capped rate mortgage, the borrower pays the floating rate or the cap rate, whichever is the cheaper on each applicable interest payment date:

- When the floating rate is lower than the cap rate, the borrower pays the floating rate.

- When the floating rate is higher than the cap rate, the borrower pays the cap rate.

Capped rate loans can be created by either the lender or the borrower, either by combining a cap with a floating rate loan or by combining a floor with a fixed rate loan.

Caps and floors are premium products. The premium for the cap or floor may be paid upfront by the borrower or else spread out over the life of the loan.

How are capped loans created?

Using caps or floors

Capped rate loans may be created by combining a floating rate loan with an interest rate cap. Alternatively, they may be created by combining a fixed rate loan with an interest rate floor.

Both strategies may be implemented by either the borrower or the lender and using either new or existing loans, as can be seen on the capped loan calculator.

Floating rate with cap

The difference between a floating rate loan and a capped rate loan is that the capped rate loan has a cap added.

A new or existing floating rate loan may be converted into a capped rate loan by adding a cap matching the floating rate loan in terms of its amount, duration, interest payment dates and reference floating rate benchmark (SONIA or Base Rate).

The combination of the floating rate loan and the cap creates a capped rate loan.

Fixed rate with floor

The difference between a fixed rate loan and a capped rate loan is that the fixed rate loan contains an adverse floor.

The fixed rate loan already has a cap in the borrower’s favour (the fixed rate) but the adverse floor prevents the borrower’s interest rate from tracking the floating rate downwards.

A new or existing fixed rate loan may be converted into a capped rate loan by adding a floor in the borrower’s favour to offset the adverse floor element of the fixed rate loan.

The combination of the fixed rate loan and the borrower floor creates a capped rate loan.

How is the premium paid?

Upfront or in instalments

The premium for the applicable cap or floor is normally paid upfront by the borrower. This is generally the case when the cap or floor is purchased independently of the loan or loans it is hedging.

Alternatively, the premium payment may be deferred by the premium cost being added to the amount borrowed and repaid in instalments over the life of the capped rate loan.

The deferred premium avoids the need for the borrower to make an upfront payment but the instalment payments add to the annual interest payments on the capped rate loan.

The instalments calculator shows how an upfront premium may be converted into instalment payments.

How are capped loans priced?

Underlying loan and premium

The pricing of the capped rate loan is determined by (1) the pricing of the underlying floating or fixed rate loan and (2) the premium cost of the applicable cap or floor.

Underlying loan pricing

A competitively priced underlying loan will tend to create a competitively priced capped rate loan.

Structural and regulatory factors in the UK market tend to make fixed rate loans more competitive than their floating rate equivalents.

But having the choice between both fixed and floating rate underlying financing gives the borrower a wider choice of alternatives.

Borrowers with access to both fixed and floating rate underlying loans are more likely to obtain keener pricing.

Option premium

The option premium is flexible because it depends on the borrower’s choice of strike rate for the cap or floor option. The flexibility lies in the trade-off between minimising the option cost and optimising the interest rate profile of the capped rate loan.

If the underlying loan is a floating rate loan, the premium payable for the cap depends on the cap rate. A cap with a higher cap rate costs less but the capped loan will have a higher maximum interest rate.

If the underlying loan is a fixed rate loan, the premium payable for the floor depends on the floor rate. A floor with a lower floor rate costs less but the capped loan will have a higher minimum interest rate.

These considerations apply whether the option premium is paid upfront or in instalments.

What are the risks of capped loans?

Loss of premium

Capped rate loans include a cap or floor in favour of the borrower. The worst that can happen is the borrower pays the premium for the cap or floor but does not receive any payments from it, for example if the interest rate stays below the cap rate for the life of a cap or if the interest rate stays above the floor rate for the life of a floor.

Provided that the cap or floor premium has been paid, there can never be a penalty to exit the cap or floor early. The early redemption value of the cap or floor will always be positive or zero. The early redemption value tends to decline as time passes.