Forward starting caps: a new option for fixed rate borrowers

This article explains how a forward starting cap can be used extend the protection currently provided by an existing fixed rate loan.

Caps are a new hedging option for most people, having previously been available only to larger business borrowers.

Background

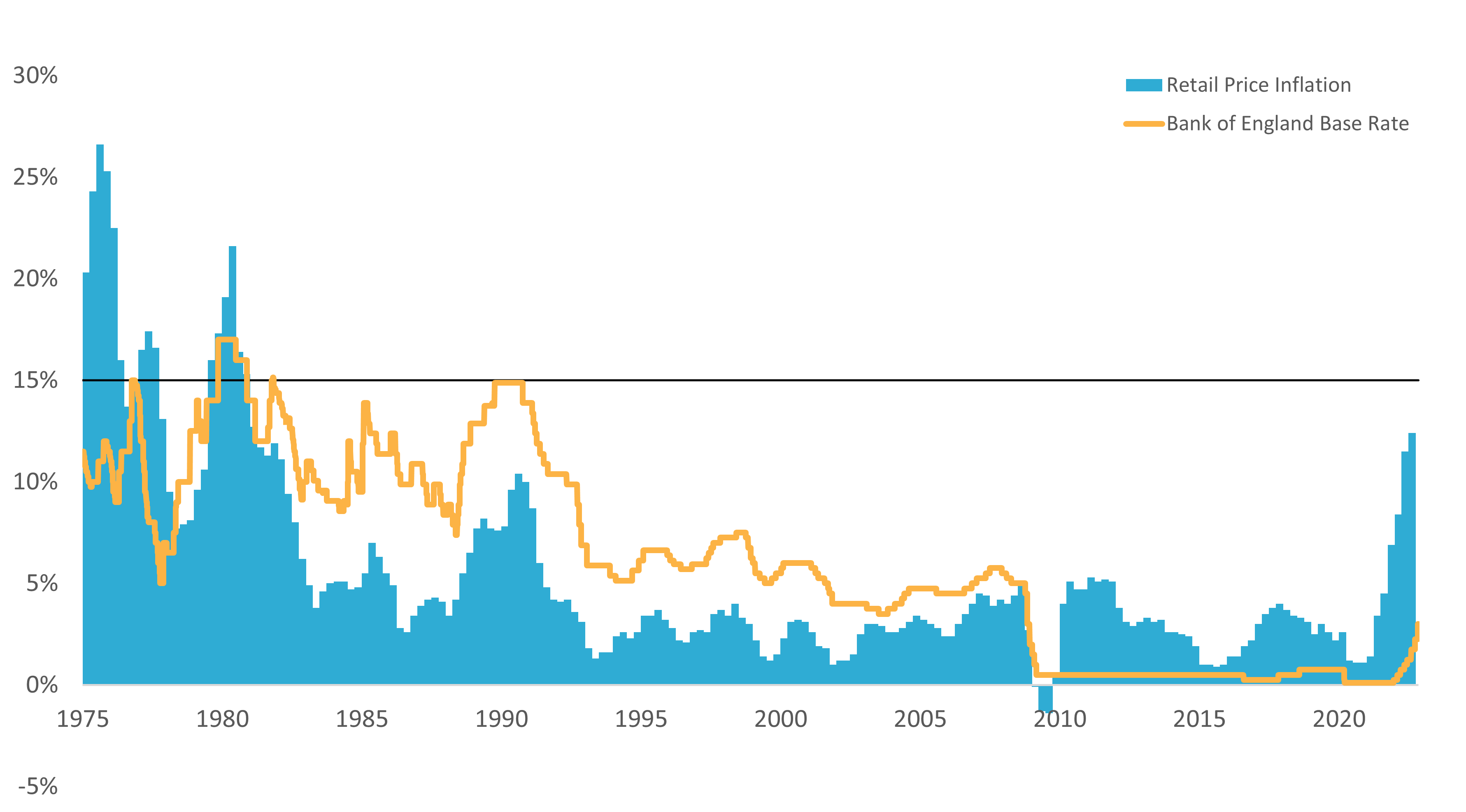

Inflation in the UK hit a 40-year high of 10.1% in July 2022, according to the Office for National Statistics, and is forecast to hit a 50-year high of over 18% in January 2023.

UK inflation and interest rates 1975 to 2022

Base Rate reached 15% during previous periods of double-digit inflation

FCA figures show that between 2018 and 2021 more than 90% of all new residential mortgage loans were at fixed interest rates. The rates were normally fixed for a period of between two and five years, meaning that many of these loans will become due for refinancing within the next three years.

The rising interest rate environment has left some borrowers concerned that, by the time they come to refinance their existing fixed rate deal, their new mortgage rate may be higher than it is today.

What can borrowers do to protect themselves against rising interest rates if they are part-way through a fixed rate contract?

Options for borrowers

Traditionally, fixed rate borrowers with the need to refinance in the future have had two options:

- Wait until the refinancing date and take the rate on offer at the time; or

- Take pre-emptive action by repaying the existing loan early and refinancing for a longer period at current rates.

This article considers a third option, which is to keep the existing fixed rate loan in place and use a forward starting cap to secure extended future protection at current rates.

What is a forward starting cap?

A forward starting cap is an interest rate cap with its start date set in the future. Interest rate caps can be seen as insurance against high interest rates. The borrower pays a premium for the cap and receives income from the cap when rates rise above an agreed cap rate. Caps are separate from the loan (or loans) that they protect, so a borrower can arrange cap protection without disrupting their existing borrowing arrangements.

The cap buyer chooses the amount of borrowing to protect, the cap rate, when the protection starts and when it ends. A borrower may buy a cap today with a its start date set to coincide with the end date of their existing fixed loan. The forward starting cap lets the borrower keep their current loan until it ends and then refinance at a variable rate with cap protection already in place.

When interest rates are below the cap rate, the borrower pays the lower variable rate. If interest rates rise above the cap rate, the borrower pays the higher variable rate but receives compensating income from the cap.

Caps are less risky than fixed rates and give better protection

The borrower with a cap is not locked into a fixed minimum rate but pays the variable rate, which tends to be cheaper for the borrower. FCA figures show that between 2007 and 2022, the interest rate on variable rate residential loans was on average 0.44% lower than the interest rate on equivalent fixed rate loans.

The three options compared

This section analyses the costs, benefits and risks of three alternative strategy options for a borrower with an existing fixed rate loan:

- Keep the existing fixed rate loan in place and wait and see;

- Repay the existing fixed rate loan early and replace it with a longer fixed rate; and

- Keep the existing fixed rate loan and hedge against future interest rises with a forward starting cap.

Option 1 – wait and see

The decision to wait until the refinancing date and take the rate on offer at the time has no immediate cost. But the borrower risks higher future loan payments if interest rates should rise between now and the refinancing date.

Option 2 – repay early and refinance with a longer fixed rate

A more risk-averse borrower may choose the second option, which is to repay their loan early and refinance with a longer fixed rate. However, this second option may have upfront costs, opportunity costs and potential exit costs:

- Upfront costs: there may be an early repayment penalty payable to exit the original loan;

- Initial opportunity costs: the replacement loan may have a higher interest rate than the original, meaning higher payments between now and when the original loan would otherwise have ended;

- Future opportunity costs: the replacement fixed rate loan may have a higher interest rate than may be available in the future; and

- Potential exit costs: early repayment charges may apply should the borrower wish to exit the replacement loan early for any reason.

Option 3 – hedge with a forward starting cap

Keeping the existing fixed rate loan and hedging against future interest rises with a forward starting cap provides better interest rate protection and greater flexibility than the alternatives:

- Option 1 – wait and see – gives the borrower no protection against rises in interest rates.

- Option 2 – repay early and replace with a longer fixed rate – locks the borrower into a fixed minimum interest rate and the possibility of having to pay early repayment penalties.

The forward starting cap allows the borrower to keep the existing fixed rate loan until its original end date and then to refinance with a variable rate loan. The borrower is protected by the cap against high variable rates but is still able to benefit from reduced loan payments when variable rates are low. The borrower also has the flexibility to repay or refinance the new loan early and/or terminate the cap, without penalty in either case.

The disadvantage of the forward starting cap is the cost of the cap premium, which is normally paid upfront. The risk is that the cap buyer pays the premium for the cap and receives nothing in return, for example if interest rates stay below the cap rate for the life of the instrument.

The costs, benefits and risks of the three options are summarised in the table below.

Costs, benefits and risks of the three options for a fixed rate borrower

| Option | Costs | Benefits | Risks |

|---|---|---|---|

| Wait until the refinancing date and take the rate on offer at the time | N/A | N/A | Higher future loan payments if interest rates should rise between now and the refinancing date |

| Repay the existing loan early and refinance with a replacement loan having a longer fixed rate period | Refinancing costs are brought forward

The replacement loan may cost more than the existing loan ERCs may apply to the existing loan |

Known fixed payments for a longer period | The replacement loan may limit the borrower’s flexibility

The replacement loan may cost more than future alternatives ERCs may apply to the replacement loan |

| Keep the existing loan and hedge with a forward starting cap | Premium payable for the cap | Interest rate protection for the life of the cap

No need to repay the existing loan early or to incur ERCs Cheaper variable loan payments when rates are below the cap rate No ERCs on the replacement variable rate loan or the cap Ongoing flexibility to repay or refinance the new loan |

If interest rates stay below the cap rate, there will be no income from the cap |

The forward starting cap gives the best protection and the most flexibility.

Relative costs

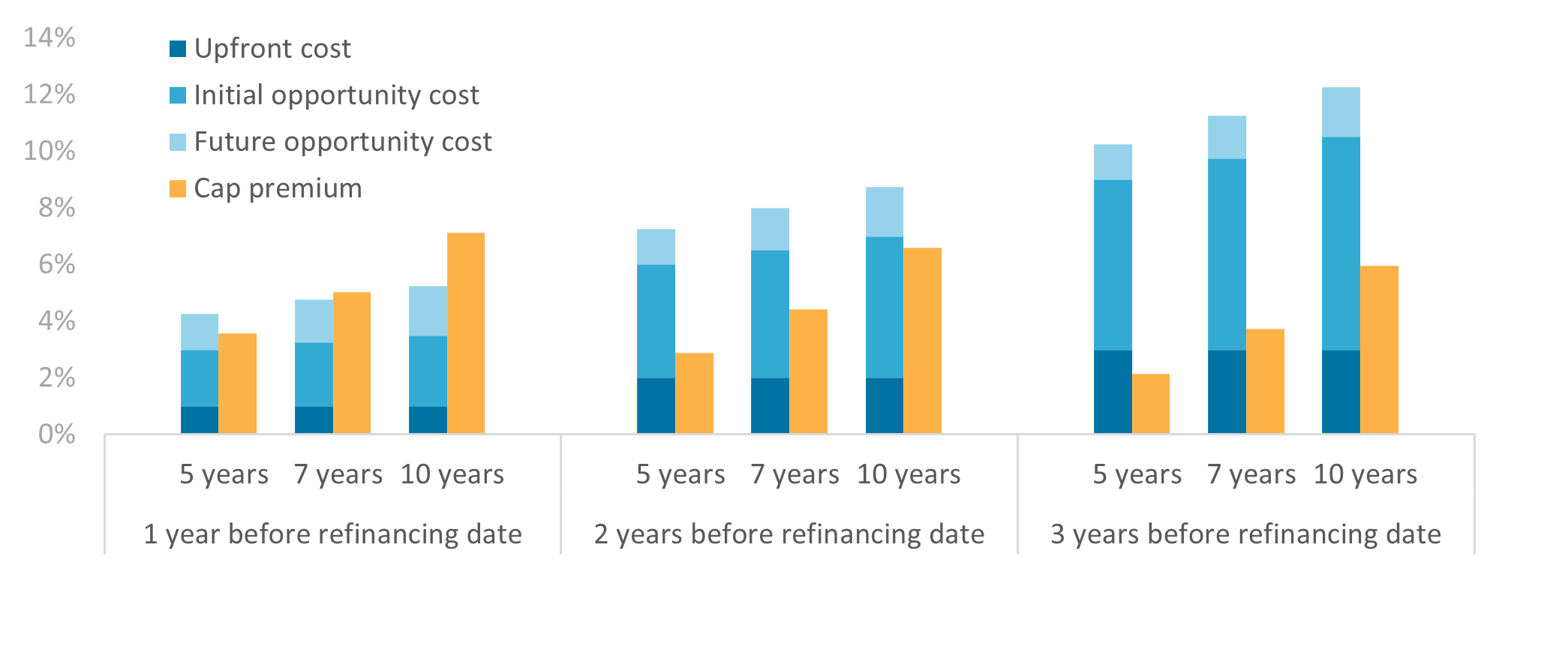

Opportunity costs represent the potential benefits that a borrower misses out on when choosing one alternative over another. The chart below compares the cost of the cap premium with the upfront and opportunity costs of the replacement fixed rate under different scenarios:

- Time to refinancing date: 1, 2 and 3 years

- Duration of hedge: 5, 7 and 10 years

Scenario analysis – cost of replacement fixed rate compared to the cap

|

Item |

Description |

Assumptions |

|---|---|---|

|

■ Upfront cost |

The early repayment charges (ERCs) applicable |

ERCs vary according to the time remaining before the refinancing date: 1% for one year; 2% for two years and 3% for three years |

|

■ Initial opportunity cost |

Extra interest under the replacement loan |

The interest rate of the existing loan is 1.25%. The replacement fixed rates are 3.25%, 3.5% and 3.75% for 5, 7 and 10 years respectively |

|

■ Future opportunity cost |

Potential extra annual cost of the |

The future variable rate is the current tracker rate of 2% |

|

■ Cap premium |

Premium payable for the forward cap alternative |

The caps have the same maturity dates as the replacement loans with cap rates set 0.25% below the respective fixed rates |

In some cases the cost of the forward cap premium may be lower than the combined upfront and opportunity costs of the replacement fixed rate. The cap tends to be more cost-effective by comparison the longer the time before the refinancing date because:

- The cap premium tends to be lower. Setting the start date further into the future without changing the end date means the protected period is shorter; and

- The costs of the replacement fixed rate tend to be higher. The longer until the refinancing date, the higher the upfront and initial opportunity costs of the replacement loan.

A cap can be a cost-effective way to extend the protection given by an existing fixed rate loan

Summary

Caps are a new hedging option for most people, having previously been available only to larger business borrowers. Caps give better protection than the equivalent fixed rates because caps do not lock borrowers into a fixed minimum rate of interest or expose them to potential early exit penalties.

The disadvantage of caps is the premium payable for the protection. The cost of the cap premium prompts some borrowers to choose fixed rates instead, regardless of the extra risks.

The early repayment charges applicable to fixed rate residential mortgages can be anomalous because the borrower may have to pay a penalty to exit their loan even if it has a lower interest rate than the current market rates. This anomaly tends to make it expensive to extend the duration of existing fixed rate protection.

In these circumstances, a forward starting cap can be a cost-effective way to extend the protection given by an existing fixed rate loan. The forward cap gives better protection than the equivalent replacement fixed rate. In some scenarios, the cap may also be the cheaper option.

Author

This article was written by Nick Stoop of Warwick Risk Management. Nick has more than twenty years’ experience as a derivatives professional and expert adviser to small and medium-sized enterprises (SMEs) and regulators about SME finance and interest rate hedging products. Prior to entering the derivatives market, Nick taught mathematics, having trained as an economist gaining a BA and an MA from Cambridge University. Nick is the founder of Cap-It, which aims to make the benefits of interest rate cap protection available to ordinary people and businesses.

Disclaimer

The material presented in this article is for general information purposes only. It should not be regarded as financial advice or an invitation to engage in investment activity of any kind. You should consult a regulated financial adviser for advice on investments.