Strategies for lenders

Applications of caps and floors

This article explains how lenders can use caps and floors to reduce risks, expand distribution, enhance market profile, improve credit quality and increase fee income.

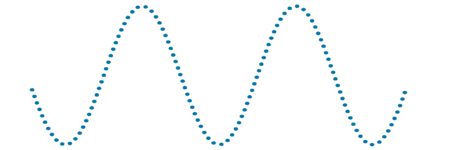

Borrowers in the UK are generally offered two financing options: a fixed rate or a floating rate loan. Neither option is optimal. Fixed rate loans expose borrowers to risks if rates fall. Floating rate loans expose borrowers to higher interest payments if rates rise.

The optimal financing solution for most borrowers is a capped floating rate loan. Capped loans give the borrower the lowest risk and the optimal interest rate.

The borrower pays the floating rate or the cap rate, whichever is the cheaper on each applicable interest payment date:

- When the floating rate is lower than the cap rate, the borrower pays the floating rate.

- When the floating rate is higher than the cap rate, the borrower pays the cap rate.

Capped loans are not widely available in the current UK market but can be readily created by transforming underlying fixed or floating rate loans into capped loans.

The transformation may be attractive to borrowers preferring capped loans to the more risky fixed or floating rate alternatives.

A fixed rate loan can be transformed into a capped loan by adding a floor in favour of the borrower. A floating rate loan can be transformed into a capped loan by adding a cap.

The transformations have clear advantages for the borrower. They have similar advantages for the lender, because they help to achieve the five objectives listed above.

The five objectives are connected with one another:

- Risk reduction is achieved through expanded loan distribution and improved credit quality. Risk-adjusted returns are enhanced by increasing fee income while reducing risks.

- Distribution is expanded by the ability to place the same underlying loan with two distinct categories of borrower without changing the lender’s net cash flows.

- The market profile of lenders offering capped loans may be enhanced in the eyes of borrowers and intermediaries.

- The credit quality of the lender’s loan portfolio is improved to the extent that its borrowers have capped loans, as outlined below.

- Fee income may be increased via margin added to the cap or floor premium and/or a spread on the option income.

These objectives may be achieved by the lender transforming normal fixed or floating rate loans into capped loans using caps and floors.

Strategy implementation

Transformation of loans

The objectives of the strategy are to reduce risks, expand distribution, enhance market profile, improve credit quality and increase fee income.

Lenders may achieve these objectives either by combining a normal fixed rate loan with a floor the borrower’s favour or alternatively by combining a normal floating rate loan with a cap.

The two alternatives each achieve optimal capped floating rate finance for the borrower, with corresponding benefits for the lender, as outlined below.

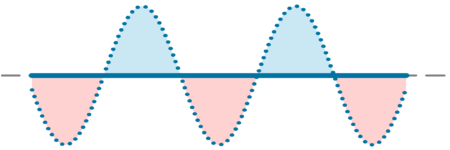

A fixed rate loan is equivalent to a floating rate loan with a cap in favour of the borrower and a floor adverse to the borrower.

Fixed rate loans give the borrower known, fixed, payments for the duration of the fixed rate period. But they also expose the borrower to risks should interest rates fall. The borrower risks becoming trapped in an expensive arrangement which may be difficult to exit without incurring potentially substantial break costs. The contingent liability created by the adverse floor element may also impact the borrower’s loan-to-value position.

The risks of a fixed rate loan can be offset with a floor in favour of the borrower. The favourable floor protects the loan arrangement from the risks of falling interest rates.

The floor owner receives extra income when the floating rate is lower than the floor rate. The further the floating rate falls below the floor rate, the greater the extra income from the floor.

Applying a favourable floor to a fixed rate loan offsets the risks of the loan by converting it into a capped loan.

The lender’s net cash flows remain unchanged whether the fixed rate loan is taken in its original form or is converted into a capped loan.

Floating rate loans allow the borrower to benefit from lower interest payments when the floating rate is low. But the risk to the borrower is that there is no upper limit on the interest rate they will have to pay should the floating rate rise.

The risk of a floating rate loan can be managed with an interest rate cap.

A cap acts as insurance against high floating rates.

The cap owner receives extra income when the floating rate is higher than the cap rate. The extra income offsets the higher interest costs of the floating rate loan.

Applying a cap to a floating rate loan offsets the risks of the loan by converting it into a capped loan.

The lender’s net cash flows remain unchanged whether the floating rate loan is taken on a capped or uncapped basis.

Analysis

Benefits to the lender

The strategy of converting normal fixed or floating rate loans into capped loans creates clear advantages for the borrower. The borrower minimises risks and pays the optimal interest rate whether rates go up or go down.

The strategy also helps the lender to reduce risks, expand distribution, enhance market profile, improve credit quality and increase fee income:

- Risk reduction is achieved because the borrower with a capped loan is likely to pay less interest so has less risk of being unable to meet loan obligations. The lender’s security position is also improved by its ownership of the applicable cap or floor.

- Expanded distribution is facilitated because the strategy allows a lender offering fixed rate and/or floating rate loans to attract a wider range of possible borrowers to its underlying product. The addition of the cap or floor converts the underlying loan into a capped loan.

The lender can offer the same underlying fixed rate and floating rate loans to new categories of borrower without changing the lender’s net cash flows in either case:

-

- Borrowers willing to take the risks of fixed rate financing may take the underlying fixed rate loan on the normal basis.

- Borrowers willing to take the risks of unhedged floating rates may take the underlying floating rate loan on the normal basis.

- Borrowers preferring to avoid risks may take the same underlying fixed or floating rate loan transformed into a capped loan via the addition of the cap or floor.

Whichever option is selected by the borrower, the lender’s net cash flows remain unchanged from those of the original loan.

- The market profile of the lender may be enhanced in the eyes of borrowers and intermediaries because capped loans are not always widely available in the current UK market.

- Credit quality: The capped loan created by the strategy has superior credit characteristics compared to the underlying fixed rate or floating rate loan:

- Loan to value: the lender’s ownership of the cap or floor increases the value of its security and so improves loan to value ratio.

- Interest coverage: the potentially lower interest payments under the capped loan make the borrower better placed to meet interest obligations.

- Fee income: The lender may potentially earn more fee income via the capped loan than it would otherwise earn via the underlying loan. The additional fee income could be in the form of a percentage of the cap or floor premium, potential extra spread income via the cap or floor, or both.

- Flexibility: The cap or floor premium can be paid upfront by the borrower, in instalments over the life of the loan, or a blend of the two. The amount of premium can be adjusted upwards or downwards by selecting a higher or lower strike rate, as can be viewed on the capped loan table.

How is the premium paid?

Upfront or in instalments

The cost of the strategy described above is the premium payable for the relevant cap or floor.

The premium for a cap or floor is normally paid upfront by the borrower. This is generally the case when the option is purchased independently of the loan or loans it is hedging.

Some borrowers prefer to pay the premium in instalments.

The lender may choose to offer deferred premium options, where the premium is payable in instalments over the life of the cap or floor regardless of what happens to interest rates. By deferring the premium payable, the lender is effectively lending the borrower the money to pay the premium so will apply a funding charge and may require additional security.

Deferring the premium cost avoids the need for the borrower to make an upfront payment. This is attractive to some borrowers, although the instalment payments effectively add to the interest costs of the loan.

Summary

Costs and benefits of strategy

The strategy outlined above explains how lenders can use caps and floors to reduce risks, expand distribution, enhance market profile, improve credit quality and increase fee income.

The cost of the strategy is the premium payable for the applicable cap or floor. The premium may be paid upfront by the borrower or added to the loan and repaid in instalments.

The benefits to the lender of the strategy include:

- Risk-adjusted returns are enhanced by the combination of increased fee income and reduced risks.

- Fee income may be increased via margin added to the cap or floor premium and/or a spread on the option income.

- Risk reduction may be achieved via expanded loan distribution and improved credit quality.

- Loan distribution may be expanded by the ability to place the same underlying loan with different categories of borrower. The lender’s net cash flows remain unchanged in either case.

- The credit quality of the lender’s loan portfolio may be improved to the extent that its borrowers have capped loans.